25+ what is dti for mortgage

Other numbers they weigh alongside DTI are your credit. Contact a Loan Specialist.

Ecfr 12 Cfr 1240 33 Single Family Mortgage Exposures

Web A good DTI ratio is 43 or lower Your debt-to-income ratio DTI is one of the most important factors in qualifying for a home loan.

. Special Offers Just a Click Away. This final rule amends the. Web For General QMs the ratio of the consumers total monthly debt to total monthly income DTI or DTI ratio must not exceed 43 percent.

Your debt-to-income ratio DTI is all your monthly debt payments divided by your gross monthly income. Web Your front-end ratio. A DTI of 43 is typically the highest.

Web Typically in the case of a mortgage your debt-to-income ratio must be no higher than 43 to qualify. For example if your mortgage payment home insurance and property. Web DTI and mortgages DTI is only one factor that lenders look at when they evaluate loan applications.

Web Loans for high DTI Simple definition. Web A debt-to-income ratio DTI is a personal finance measure that compares the amount of debt you have to your overall income. Get Your Quote Today.

Choose Wisely Apply Easily. Web When you apply for credit your lender may calculate your debt-to-income DTI ratio based on verified income and debt amounts and the result may differ from the one shown here. Web What is a debt-to-income ratio.

This divides your total housing expenses by your gross monthly income. Web Your front-end or household ratio would be 1800 7000 026 or 26. Debt-to-income ratio DTI Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their.

Compare Home Financing Options Get Quotes. Compare the Lowest Mortgage Rates. Find the One for You.

DTI determines what type of. Web A DTI ratio simply represents how much of your gross monthly income is spoken for by creditors and how much of it is left over to you as disposable income. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

That is the highest ratio allowed by large lenders unless they. Check How Much Home Loan You Can Afford. Web Your DTI is the percentage of your monthly income devoted to paying debts.

Mortgage lenders include this ratio to determine your ability to repay a loan. VA Loan Expertise and Personal Service. Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt.

This number is one way. Lenders including issuers of. To get the back-end ratio add up your other debts along with your housing expenses.

Web To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other regular. Compare Home Financing Options Get Quotes. Check How Much Home Loan You Can Afford.

How To Calculate Debt To Income Ratio Dti Ratio

Mortgage Banker Magazine April 2020 By Ambizmedia Issuu

What Is Debt To Income Ratio Moneytips

Debt To Income Dti Ratio What S Good And How To Calculate It

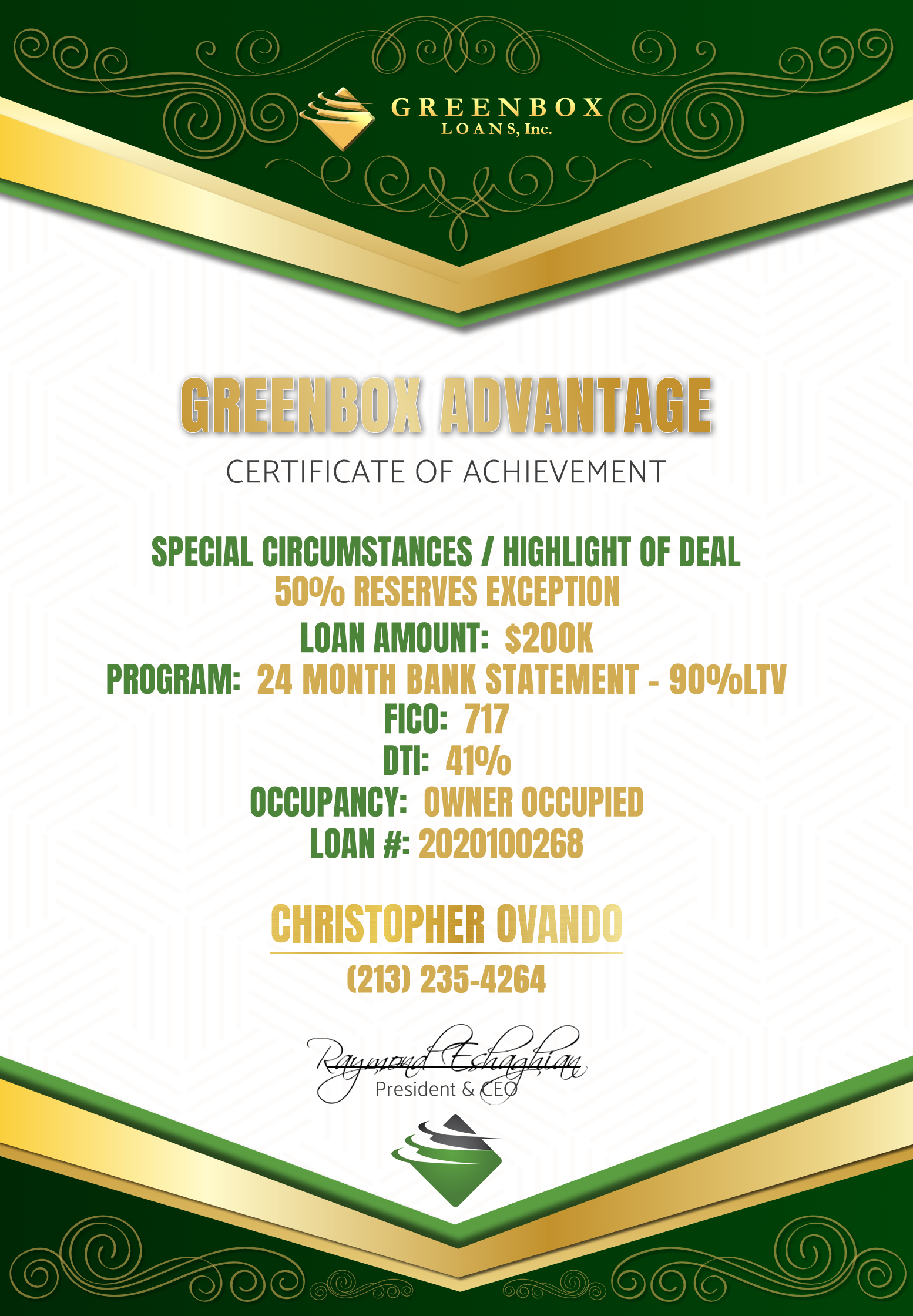

Greenbox Loans Inc Revolutionizing The Lending Industry

What Is Debt To Income Ratio Definition How To Calculate Dti Ratio

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

National Mortgage Professional July 2020 By Ambizmedia Issuu

How To Lower Your Mortgage Debt To Income Ratio Dti Better Mortgage

:max_bytes(150000):strip_icc()/banking-close-up-debt-1842608-b54f0f8ea9b041efa315f75ad76e5f42.jpg)

How Much Should I Have Reasonable Amount Of Debt Explained

House Poor Common Mistakes You Should Learn To Avoid Now Savoteur

How To Lower Your Mortgage Debt To Income Ratio Dti Better Mortgage

What Is A Good Debt To Income Dti Ratio For A Home Mortgage The Home Mortgage Pro Blog

Debt To Income Ratio Advance America

Debt To Income Ratio Loan Pronto

Does Having Positive Cash Flowing Rental Properties With 20 To 25 Equity Increase Or Decrease The Chance To Get Big Mortgage To Purchase My Primary House Quora

Debt To Income Ratio For Mortgage Definition And Examples